Anyway, I want to delve deeper in debt...specifically calling attention to this "Student Loan Bubble." Firstly, I want everyone to understand that the purpose of my last post was not just to complain about my student loan situation (ha. who am I kidding...okay maybe partially it was), but instead to provide a snapshot of the seriousness of the student loan matter from someone who is actually in it. Furthermore, through writing my story, I have become much more intrigued by this "Student Loan Bubble" that some suspect is currently brewing and how this is going to impact the economy IF this bubble does in fact burst.

Take a look at this:

And this:

Dude...this mess is crazy. How are you feeling about it? What do you think will ultimately happen? I'm not completely willing to jump onto the "this is going to turn out just like the housing bubble" bandwagon yet...but I'm definitely not confident that we haven't gotten ourselves into a ton of trouble here. But what is the solution?

College prices have sky rocketed, partially due to how easily colleges saw students getting money to pay them. Hey why not up the prices, these students have somewhere to get the cash from! If student loans become more difficult to get does that necessarily mean lower college tuition or just less people going to college? But...is less people going to college a totally horrible thing? I've read that the difference in income for a college grad versus a high school graduate is about $7,500 per year. Now I paid more than that this year alone in my student loan INTEREST. Granted that $7,500 probably becomes exponentially larger as we go farther into our careers...it still goes to show that while college is in fact an investment...it isn't always a good one. I think in all of this student loan talk...people have forgotten about one verrrrry important component of any investment...

ROI.

And with that...all I have left is...

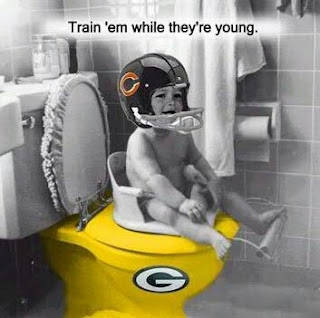

Go Bears!

Orman just scared the crap out of me. I pay $ 1300 in loans every month!!! and I will be stuck with this for the next 10 years. God forbid I lose my job and I'm done. This is a real problem that MUST be addressed.

ReplyDelete